Explore the latest.

-

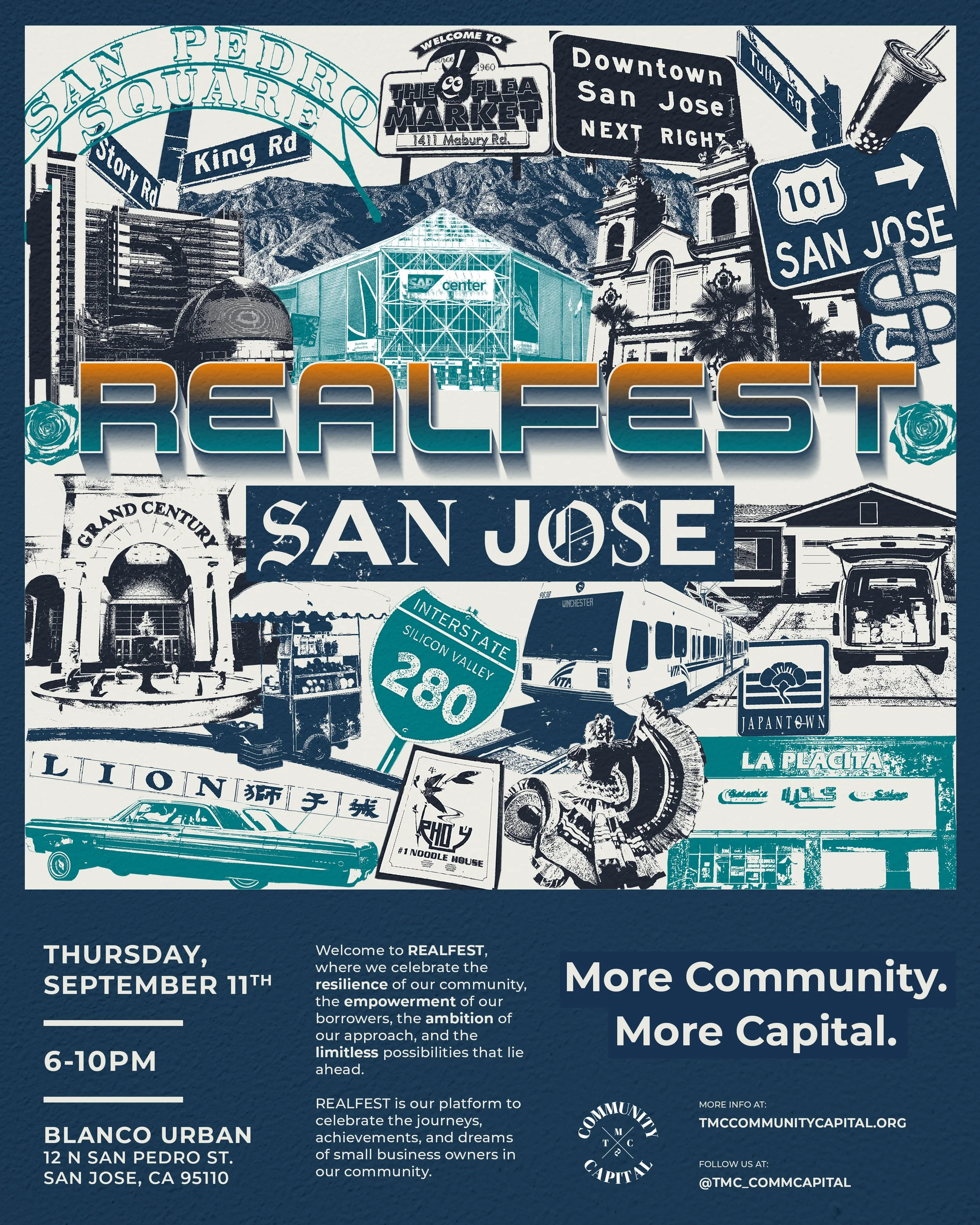

REALFEST 2025 Lands In San Jose

TMC Community Capital is bringing its flagship event, REALFEST, to Downtown San Jose on September 11th, 2025. This year's gathering is all about celebrating the small business owners, community champions, and the everyday hustle that keeps California moving.

-

First Foundation Bank Partners With the Federal Home Loan Bank of San Francisco to Award $100,000 Grant to TMC Community Capital

Business Wire

First Foundation Bank, in partnership with the Federal Home Loan Bank of San Francisco, is proud to announce a $100,000 grant awarded to TMC Community Capital (TMC). This grant highlights First Foundation Bank's commitment to promoting economic growth and financial inclusion in underserved communities.

-

Wildfire aid resources: From shelter and food to mental health and insurance

KCRW

TMC Community Capital provides immediate relief grants of $5000 to entrepreneurs and small businesses whose livelihoods have been impacted by the wildfires.

-

Domestic workers lost a community in Pacific Palisades too

LAist

Small businesses or self employed people who make under 250,000 can apply to TMC Community Capital’s lottery program, which is funded by the Latino Community Foundation and others -

Loans and Relief Options for Rebuilding Your Small Business After the Fires

LA Times, March 10th

In response to the recent Los Angeles wildfires, there are several resources available to help small businesses get loans and financial assistance for rebuilding

-

Daily Inspiration: Meet Lisa Rocha

Voyage LA

Thanks to a $5,000 Milestone Loan from TMC Community Capital, Lisa’s business ilaments received crucial funding that enabled investments in new equipment, advertising, and website design. This financial support was particularly significant given Lisa’s challenges in qualifying for traditional business loans. -

California Wine Concierge and Lounge Thrives with Support from Local CDFI

Opportunity Finance Network

Cynthia discovered TMC Community Capital, a nonprofit CDFI committed to leveling the financial playing field for women-owned, low-income, and under-resourced small businesses in California, where she secured a $20,000 loan to support her business. -

Meet Adolfo Guevara | Business owner & Baker

Shoutout LA, December 12th 2024

With support from TMC Community Capital and a grant from Greg & Jodi Perlman and the team from The Change Reaction, Guevara’s Bakery has flourished, allowing Adolfo and Jessie Guevara to focus on their craft and community. -

TMC Community Capital and The Change Reaction Partner to Pay Off Loans for Hardworking Small Businesses

26 Entrepreneurs receive unexpected financial boost to help their business thrive while creating hundreds of jobs in Southern California

-

Announcement: REALFEST 2024 Lands in Los Angeles

REALFEST, the groundbreaking event celebrating the transformative power of small businesses, is returning for its second year, bringing its vibrant community impact to the Los Angeles Arts District.

-

Strengthening Financial Education: TMC Community Capital Partners with The Brick TV

TMC Community Capital is proud to announce its partnership with The Brick TV, a streaming platform dedicated to addressing the needs of underrepresented creators and communities.

-

Microlender opens in downtown San Jose, hopes to bolster small firms

The Mercury News, July 1st, 2024

TMC Community Capital has begun operating in downtown San Jose and intends to offer low-cost loans to businesses and individuals.

-

TMC Community Capital is setting up shop in Downtown San Jose

The San Jose Blog, July 1st, 2024

TMC Community Capital is moving into their Downtown San Jose office at 44 S. 1st Street. on July 1st. The company specializes in providing affordable microloans ranging from $5,000 to $50,000 to underserved entrepreneurs. -

TMC Community Capital Is Opening Doors for Small Business Owners in San Jose

TMC Community Capital is proud to announce the grand opening of its new office in Downtown San Jose, marking a significant milestone in the nonprofit microlender’s mission to advocate for financial justice among marginalized communities in California.

-

Wells Fargo's $500k Grant Spurs Innovation with TMC Community Capital’s Microloan Lite

Over the past 12 months, TMC Community Capital has been utilizing the $500,000 grant awarded by Wells Fargo to support small businesses and pilot their innovative Microloan Lite program.

-

Thank You Umpqua Bank

In its first community grants cycle of 2023, the Umpqua Bank Charitable Foundation, a 501(c)(3) organization of Umpqua Bank, under the parent company Columbia Banking System, Inc. (Nasdaq: COLB), has awarded 78 grants to local nonprofits including TMC Community Capital.

-

Thank You, The SAM Initiative

The SAM Initiative has generously granted $80,000 to TMC Community Capital, recognizing the organization's dedication to driving social change and promoting economic independence. We are grateful to the SAM Initiative for their investment in our mission and the positive impact it creates for our community.

-

TMC Community Capital: A Lighthouse For Underserved Entrepreneurs

Benzinga, May 26, 2023

Amid the thriving entrepreneurial landscape of California, a transformative financial force has emerged. This force, known as TMC Community Capital, eschews traditional lending practices and the associated barriers. Its innovative approach to approving loans offers a breath of fresh air in the financial world. -

Thank you NALCAB

The National Association for Latino Community Asset Builders (NALCAB) has awarded TMC Community Capital $35,000 in funding and specialized training to more effectively serve minority business owners.

-

How Eco Delight Coffee Fulfilled New Contract with Help of CDFI Financing

Opportunity Finance Network, April 28, 2023

Guillermo, in business for 11 years with over half a million dollars in cash, was rejected for funding due to lack of financial history and credit issues when trying to secure funds for a new contract. Luckily, he discovered TMC Community Capital.

-

First Foundation Banks supports our mission with a $15,000 gift

Thank you for your investment in access to affordable capital.

-

Thank you Banner Bank!

TMC Community Capital is so grateful for your support of our work serving credit-invisible entrepreneurs.

-

FOUND/LA gives $125,000 in lending capital

We are so excited and grateful to welcome a new investment in our loan products!

-

A huge thanks to First Republic Bank for their continued contribution to our work

Thank you for supporting our operations as we continue to grow our organization and innovate for equity.

-

We'd like to say thank you!

It’s always a privilege to welcome a new funding partner!

-

Thank you for your support!

2022 was a huge year for us, and we have so much more in store for 2023.

-

Thank you for your contribution!

We’ve served over a third of California counties, and increased our reach to rural businesses by over 100% in the last year!

-

We're so grateful for your support!

We’d like to thank the FHL Bank of San Francisco for supporting our work through their AHEAD program.

-

Wells Fargo Wells Fargo Foundation Awards $500,000 to TMC Community Capital for Equitable Lending

We are so proud and excited to be making strides in new Racially Just Underwriting models

-

Thank You Capital One

Thank you for your investment in our work supporting under resourced entrepreneurs impacted by the COVID-19 pandemic.

-

OFN CDFI Tech Grant Awardees

The OFN CDFI Technology Grant Program supported by Google.org provided $11 million to support 55 OFN member CDFIs across the country. TMC CC is thrilled to be included among other great awardees.

-

OFN Finance Justice Fund Reaches Full Deployment of $100 Million Twitter Investment

OFN congratulates the latest Finance Justice Fund recipients. We are grateful to be a recipient.

-

Small Business Microlender TMC Community Capital Names New CEO

San Francisco Business Times, May 16, 2022

The lender's first full-time CEO has deep roots in microfinance, which is focused on making business loans to women, minority and low-income entrepreneurs.

-

OEDCA Co-Hosts Meeting with Flea Market Vendors

City of San Jose, March 21, 2022

OEDCA Director Nanci Klein introduced the OEDCA staff member and interpretation teams, along with an impressive line-up of community-based organizations that are able to provide no- or low-cost support and information on loans, grants, and business services to Flea Market vendors.

-

Angelina Velázquez, Owner of Jello Fantasy, Isn't Afraid to Ask for Help

SAN JOSE — February 22, 2022 4:30pm

Local lender and technical assistance provider help retailer expand during pandemic

-

TMC CC Announces New Accelerated Microloan Program

January 2, 2022

TMC Community Capital (TMC CC) is thrilled to announce the rollout of our new pilot microloan program, Microloan Lite, focused on increasing the accessibility and efficiency of small loans between five and ten thousand dollars.

-

A lesson in resilience: How Ylenia Mino painted her way through the pandemic

Long Beach Business Journal, August 16, 2021

When the pandemic restrictions shut down her business, Ylenia Mino had to shift focus. A $5,000 Bloom small business grant facilitated by TMC Community Capital helped her doors stay open.

-

$1.2M Chain of giving grants California small businesses a second chance

August 6, 2021

Over the past 8 months, TMC Community Capital facilitated $1.2 million in grant funding towards California small business hit hard by the COVID-19 pandemic.

-

TMC Community Capital wins CDFI Certification expanding opportunities for underbanked businesses across California

August 2, 2021

TMC Community Capital (TMC CC) has been certified as a Community Development Financial Institution (CDFI) by the U.S. Department of the Treasury. It joins a network of like-minded organizations that provide financial services to low-income communities and individuals who are excluded from typical forms of lending.

-

First Foundation Bank supports recovery loan program for California small businesses

June 7, 2021

TMC Community Capital (TMC CC) has launched a Recovery Loan Program for small businesses impacted by the coronavirus pandemic. The Recovery Loan Program, made possible in part by a generous donation from First Foundation Bank, is designed to support California’s small businesses—especially those located in economically disadvantaged and historically under-banked areas of the state.

-

TMC Community Capital welcomes new business development officer

June 7, 2021

TMC Community Capital is excited to welcome our new Business Development Officer, Mayra Contreras, to the team. She brings a wealth of experience in community development, with over 14 years of experience in the financial services space and six years in microlending.

-

Recovery support for vulnerable small businesses - nonprofit microlender is awarded $25,000 from MUFG Union Bank

June 1, 2021

TMC Community Capital (TMC CC), was awarded $25,000 from MUFG Union Bank to support a Recovery Loan Program for small businesses impacted by the coronavirus pandemic.

-

Generous donation from a local couple helps small business bloom in times of crisis

May 18, 2021

In partnership with TMC Community Capital, the Bloom Grant Program has provided 20 struggling small businesses in Long Beach, Lakewood, Seal Beach, and Los Alamitos with $5,000 each in economic assistance.

-

New non-profit microlender launches grant program for struggling small businesses in LA County

February 4, 2021

Federal relief packages like the PPP loan often failed to reach those who needed it most, with only 2% of funds going to minority-owned businesses (Forbes). The Recovery Fund was launched to help mitigate this harm and provide relief to those businesses in greatest need.

-

How an L.A. indie bookstore’s GoFundMe inspired a small business lifeline

Los Angeles Times, December 25th, 2020

In partnership with Pacific Community Ventures and TMC Community Capital, the owners of skin-care company Dermalogica decided to launch Found/L.A. Small Business Recovery Fund, a $1-million grant program to help small minority-owned businesses in Los Angeles County stay open during the pandemic.

-

Bay Area business lender TMC Community Capital debuts small business recovery loan program

Los Angeles Times, Nov. 30th, 2020

“The pandemic has brought into clear focus the importance of small business in the community in a way that I’ve never seen before,” Morrison said, adding that the new wave of Covid shutdowns – and the lack of additional federal relief legislation – has been devastating for many of these firms.”

-

Country Kids Business Benefits From CARES Act Grant Funds

Escalon Times, Nov. 25th, 2020

“The local Country Kids Child Development Center was among more than 600 businesses in San Joaquin County to receive some funds through the CARES Act. It was one of seven Escalon businesses or non-profits to receive a grant, with the funding distributed for a variety of needs.”

-

In Her Own Words: TMC Community Capital helps Dream ChaseHer founder Jennifer Hammock live up to its name

Biz Women, Nov. 16th, 2020

“I love seeing my clients expand their personal confidence. They come to me questioning if they have what it takes to accomplish their goals, but after working with me, their manifestations become reality. I love to know that I played a part in helping another woman’s dreams come true.”

-

In Her Own Words: Joyce Sloss’ consultancy was based on airports until Covid-19 took flight

Biz Women, October 30, 2020

"Knowing when to pivot in your career or with your company is critical. It takes courage. After a long career working for the City of Los Angeles, I took the risk to start my own consulting firm.”

-

In Her Own Words: TMC Community Capital’s Hanna Leen sees both sides of mentorship

Biz Women, Oct. 19th, 2020

“Being a great recipient means so much to me and my business. It was the blessing I'd been waiting for some time now, and TMC Community Capital made it come true. It was the support and encouragement we needed to continue in this stressful and discouraging time.”

-

In Her Own Words: TMC Community Capital’s Hanna Leen sees both sides of mentorship

Biz Women, October 8, 2020

“I am passionate about giving back and providing mentorship to the younger generation. I now serve on the Financial Women of San Francisco Scholarship Committee and have the privilege of meeting women with bright futures.”

-

In Her Own Words: Oakland florist Ariana Marbley uses a local grant to grow her business

Biz Women, October 5th, 2020

"Inspired by my grandfather’s love of gardening, I decided to open my florist shop, Esscents of Flowers, in Oakland, California in 2016. I am a proud East Oakland native and I am proud to own a business in a community that is rich in culture and political awareness.”

-

In Her Own Words: Barbara Morrison spent the pandemic giving women access to capital, not talking points

Biz Women, September 3, 2020

As our communities reopen, women across America see their lives becoming more complicated as they juggle responsibilities at home and at work (which is often still at home), caring for coworkers, customers and family.

-

Women, people of color need fairer access to capital

Capital Weekly, August 25, 2020

Study after study shows women business owners, particularly women of color, face inequities accessing needed capital. According to a report from the Senate Committee on Small Business Entrepreneurship, less than 5% of small business lending finds its way to women entrepreneurs, a mere $1 for every $23 lent.

-

Building a Better Bay Area

ABC 7 New, August 3, 2020

CEO and Founder, Barbara Morrison shared about the Small Business, Big Heart Grant Program. Taylor Jay, one of the grant recipients, joined Morrison to share her story as an owner of a clothing shop in Oakland. We are proud to help small businesses like hers.

-

Lender debuts grant program for smallest of small businesses in Los Angeles

News Break, July 17, 2020

Protests over racial injustice in recent weeks spurred TMC Community Capital to create a $750,000 grant program supporting microbusinesses that are often women and minority owned.

-

TMC Community Capital launches grant program with support from Signature Bank and TMC Financing

Yahoo Finance July 16, 2020

“We are grateful for the support from Signature Bank and TMC Financing, which makes this program possible,” said Hanna Leen, program manager of TMC Community Capital. “Small businesses pulled the economy out of the Great Recession by creating two-thirds of all net new jobs. With everyone’s help, it can be done again.”

-

Lender debuts grant program for smallest of small businesses in Los Angeles

Los Angeles Business Journal, July 16, 2020

“The stories of the struggles facing our very small businesses are heartbreaking, and I wanted to do more, especially for women and minority-owned businesses that weren’t able to access the federal funding,” TMC Financing’s founder and CEO Barbara Morrison told me.

-

TMC Community Capital Launches Grant Program with Support from Signature Bank and TMC Financing

Business Wire, July 16, 2020

“We are pleased to support TMC’s innovative grant program. Our $250,000 donation is earmarked specifically for helping restore primarily those minority and women-owned small businesses throughout the Bay Area and the greater Los Angeles region - where the Bank has operations. This affords Signature Bank the opportunity to strengthen the most vulnerable small businesses - those that make up the fabric of our dynamic, local communities,” said Joseph J. DePaolo, President and Chief Executive Officer at Signature Bank.

-

Bay Area business lender TMC Community Capital debuts small business recovery loan program

ForexTV.com, July 15, 2020

In creating a grants program for microbusinesses, often owned by women of color, TMC Community Capital’s CEO, Barbara Morrison said: “We don’t work in the social justice world. I view our lane as economic justice.”

-

Bay Area lender debuts grant program for smallest of small businesses

San Francisco Business Times, July 15, 2020

“We wanted to build a program that was easy and equitable, so we are turning to members of the community and asking them to champion the small businesses they love,” Morrison said. “We hope to serve 100 of the most vulnerable businesses with the majority of them owned by women of color.”

-

Bay Area finance veteran takes aim at Square, PayPal with new lending service

San Francisco Business Times, December 11, 2019

Barbara Morrison, founder and president of TMC Financing, has created TMC Community Capital to offer an alternative to merchant cash advances offered by Square, PayPal and others. TMC Community Capital plans to market its service to women-owned businesses.